Saving for retirement is one of the most important financial goals you’ll ever pursue. Yet many people don’t know how much they should be saving—or when to start. The truth is, the earlier you begin, the easier it is to build a secure financial future. Compound interest rewards consistency and time, not perfection.

In this article, we’ll break down how much to save for retirement at every age, what factors to consider, and how to get on track no matter when you start.

1. Why Retirement Planning Matters Early

Retirement may feel far away, but time is your most valuable ally. Thanks to compound interest, your money grows faster the longer it’s invested. For example:

If you start saving $300 per month at age 25, earning an average of 7% annually, you’ll have around $750,000 by age 65.

But if you start at 35, you’d need to save nearly $650 per month to reach the same goal.

Starting early means you can save less and still end up with more.

2. The 15% Rule: A General Starting Point

Financial experts often recommend saving at least 15% of your gross income each year for retirement. That includes contributions to your:

-

Employer retirement plan (like a 401(k))

-

IRA (Traditional or Roth)

-

Other investment accounts

If you can’t start at 15% immediately, start smaller—say, 5%—and increase your contributions by 1–2% each year until you reach your goal.

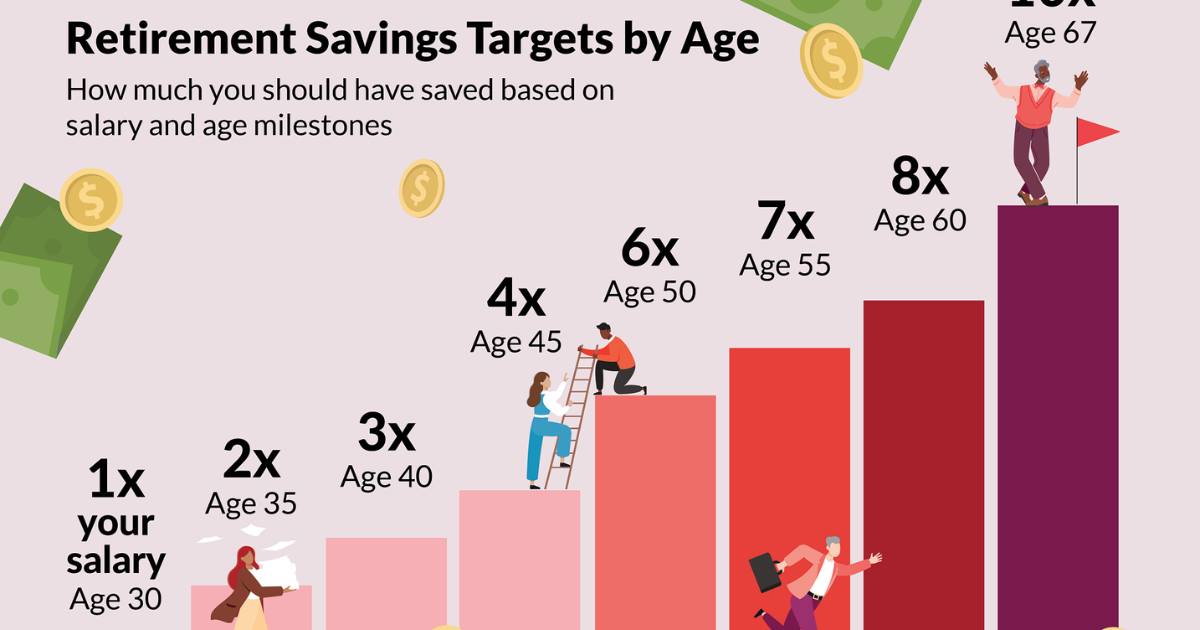

3. How Much to Save by Age

Here’s a simple age-by-age savings guide, assuming you plan to retire around age 65.

By Age 25: Save 0.5x Your Annual Salary

At this stage, your focus should be on starting early and building good financial habits.

If you earn $35,000 a year, aim to have at least $17,500 saved by age 25.

Key Tips:

-

Contribute enough to get your employer’s 401(k) match—it’s free money.

-

Focus on building an emergency fund and paying down high-interest debt.

By Age 30: Save 1x Your Annual Salary

By 30, aim to have your annual income saved for retirement.

If you earn $50,000 a year, that means about $50,000 in savings.

How to Get There:

-

Contribute 10–15% of your income consistently.

-

Invest in growth-oriented assets (like stock index funds) since you have decades ahead.

-

Automate your savings so you never miss a contribution.

By Age 40: Save 3x Your Annual Salary

Your 30s and 40s are prime earning years. By age 40, you should ideally have three times your salary saved.

If you make $70,000, that’s around $210,000 saved.

Tips for the 40s:

-

Max out your retirement accounts if possible.

-

Reevaluate your investment mix—keep a majority in stocks but consider adding some bonds.

-

Avoid lifestyle inflation; direct raises and bonuses toward your retirement fund.

By Age 50: Save 6x Your Annual Salary

At this point, you should be getting serious about retirement planning.

If your annual income is $80,000, aim for $480,000 in savings.

Key Actions:

-

Take advantage of catch-up contributions (extra $7,500 allowed for 401(k)s and $1,000 for IRAs).

-

Review your retirement goals and expected expenses.

-

Pay off high-interest debts to reduce your financial burden in retirement.

By Age 60: Save 8x Your Annual Salary

As retirement nears, it’s crucial to lock in your progress.

If your income is $90,000, aim for around $720,000 saved.

Next Steps:

-

Adjust your portfolio to become more conservative—protect what you’ve built.

-

Estimate your Social Security benefits and potential pension income.

-

Consider healthcare costs and whether you’ll need long-term care insurance.

By Retirement (Age 65+): Save 10x Your Annual Salary

By the time you retire, a good target is to have about 10 times your annual income saved.

If you earn $100,000 before retiring, that means $1 million in retirement savings.

This amount should allow you to replace around 70–80% of your pre-retirement income when combined with Social Security and other income sources.

4. Adjusting for Lifestyle and Goals

Everyone’s retirement looks different. Some people want to travel; others just want a quiet, comfortable life. Your savings goal depends on:

-

Desired retirement age (earlier retirement requires more savings).

-

Expected lifestyle costs (city living vs rural, travel plans, etc.).

-

Healthcare and insurance needs.

-

Pension or Social Security benefits.

If you expect a modest lifestyle or additional income (like rental property), you might not need the full 10x rule. On the other hand, an early retirement or high-cost lifestyle will require more aggressive savings.

5. Tips to Stay on Track

Automate your savings: Set up automatic transfers to your retirement account.

Increase contributions with raises: Each time you earn more, raise your savings rate.

Diversify investments: Mix stocks, bonds, and other assets to balance growth and security.

Avoid withdrawals: Early withdrawals can lead to penalties and lost growth.

Review annually: Adjust your plan as income, expenses, and markets change.

Final Thoughts

Saving for retirement doesn’t require a perfect start—it just requires starting. Whether you’re 25 or 55, the key is to make consistent contributions and let compound growth work for you.

Use these benchmarks as a guide, not a rulebook. Life changes, careers evolve, and markets fluctuate—but staying disciplined and proactive will help ensure that when the time comes to retire, you can do so comfortably and confidently.